Payback period calculation formula

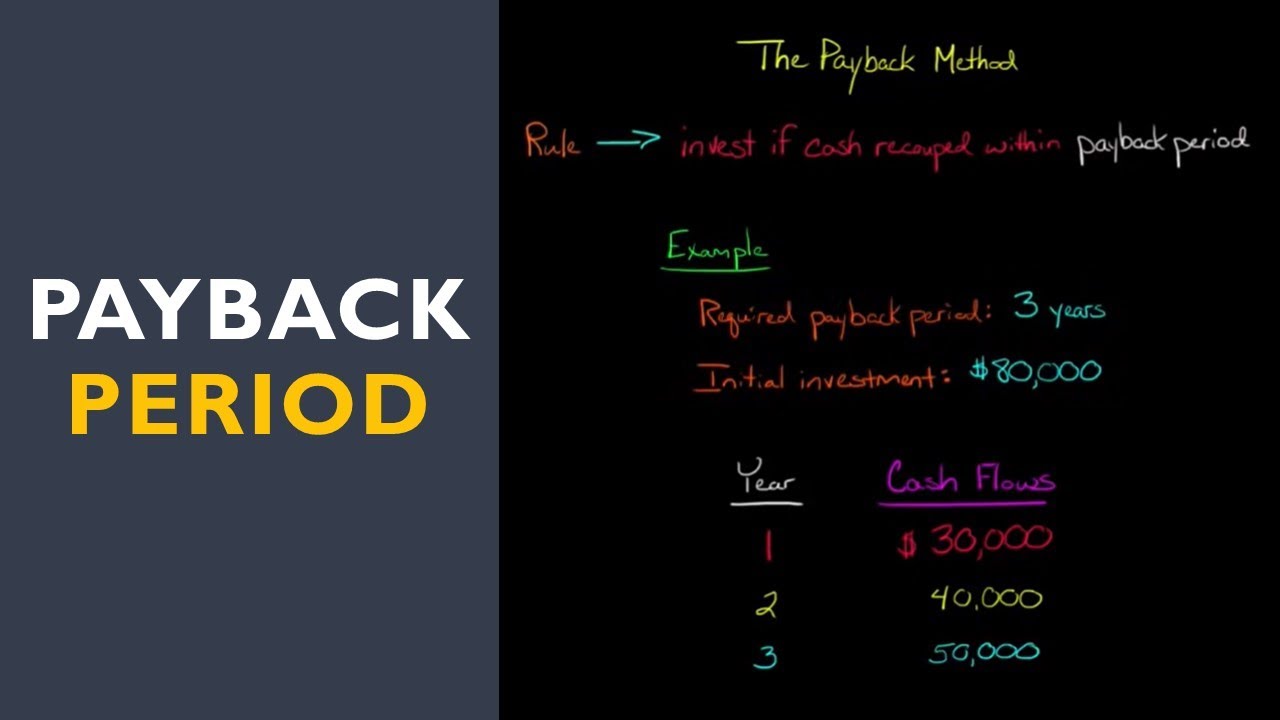

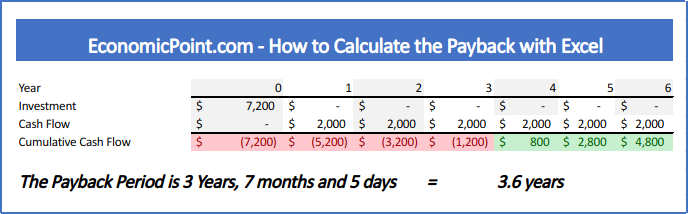

Year 1 0 Year 2 20000 Year 3 30000 Year 4 50000 Year 5 100000 In this case we must subtract the expected cash inflows from the 100000 initial expenditure. The payback period is calculated by dividing the initial capital outlay of an investment by the annual cash flow.

How To Calculate The Payback Period Youtube

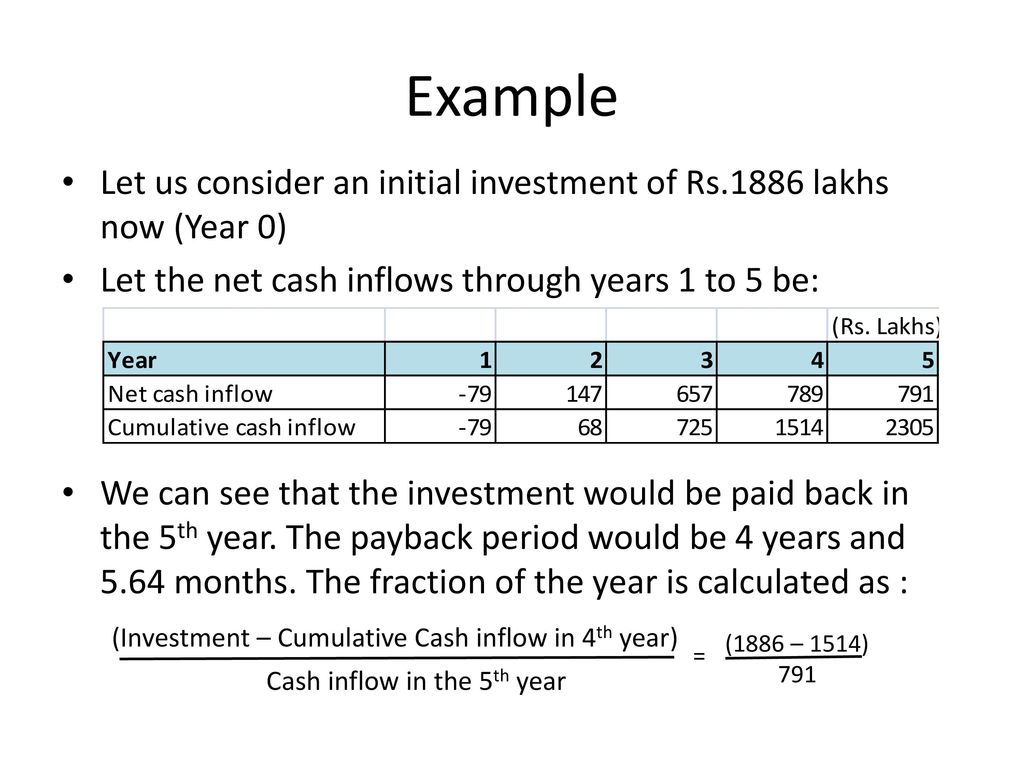

Uneven Cash Flows Company C is planning to undertake another project.

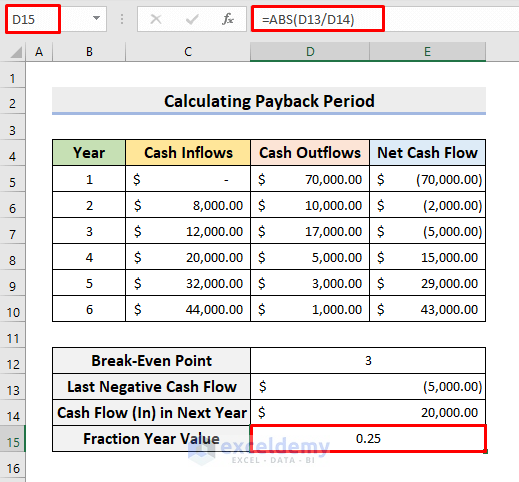

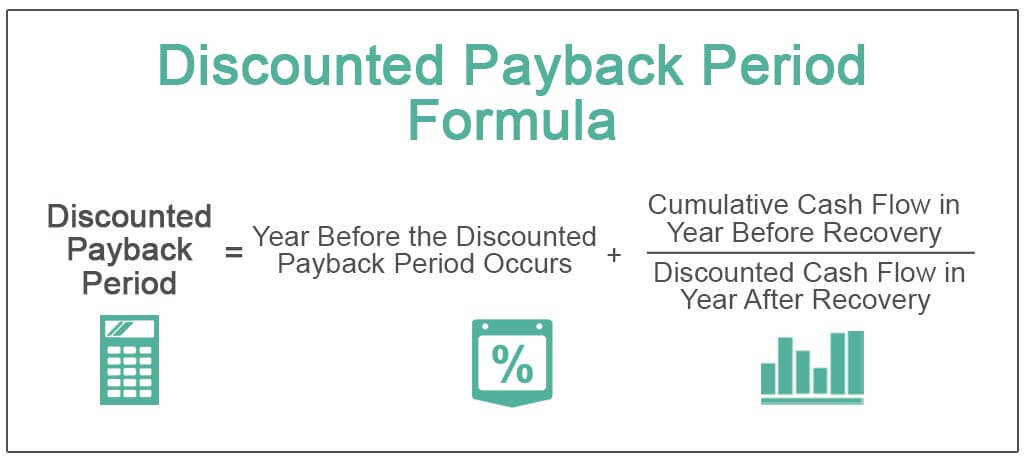

. You can use the payback period. How to Calculate a Payback Period. Payback Period Years Before Break-Even Unrecovered Amount Cash Flow in Recovery Year Here the Years Before Break-Even refers to the number of full years until the break-even point.

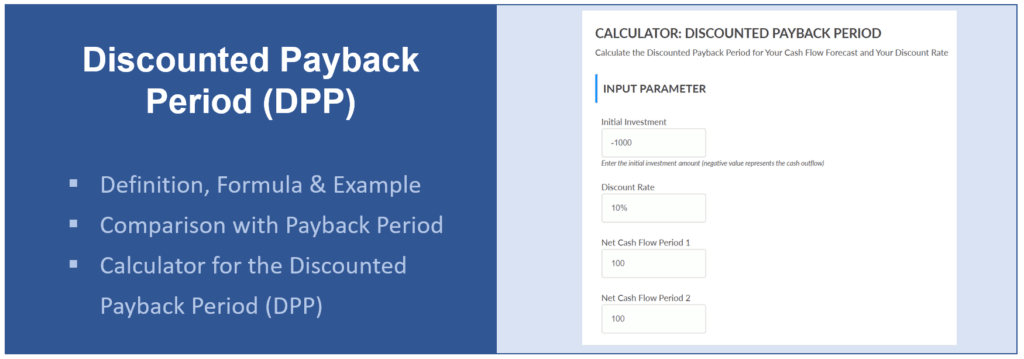

100 20 5 years Discounted. Payback Period Initial Investment Annual Payback For example imagine a company invests 200000 in new manufacturing equipment which results in a positive cash flow of 50000 per. Hence the total pay-back period will be 4022 422 years as below.

Formula The simple payback period formula is calculated by dividing the cost of the. Payback Period Formula And Calculator Excel Template Financial value and project cost. Management uses the payback period calculation to decide what investments or projects to pursue.

The formula for calculation of payback period fixed cash flow mentioned-earlier in the content. Payback reciprocal is the reverse of the. Payback Period Formula In this formula the net cash flow would be over the course of the set payback period.

The result of the payback period formula will match how often the cash flows are received. This means that at some point in time they will. The length of time YearsMonths needed to recover the initial capital back from an investment is called the Payback Period.

Payback Period Initial investment Cash flow per year As an example to calculate the payback period of a 100 investment with an annual payback of 20. Mileage calculation provided by. Payback Period Initial Investment Annual Cash Flow.

When businesses choose to make an investment they will do so with the goal of eventually breaking even. An example would be an initial outflow of 5000 with 1000 cash inflows per month. So now we know that 422 is the payback period in which we will recover our initial cost of investment of.

In this the amount of net cash flow varies over time and termed as. Also in order to use this formula the net cash flow must remain. Payback Period formula Full Years Until Recovery Unrecovered Cost at the beginning of the Last YearCash Flow During the Last Year.

Step 2 Calculate the CAC Payback Period. Payback Period Initial Investment Annual Cash Flow 105M 25M 42 years Example 2. The payback period is the length of time required to recover the cost of an investment.

The payback period of a given investment or project is an important. Payback Period Initial Investment Annual Payback For example imagine a company invests 200000 in new manufacturing equipment which results in a positive cash flow of 50000 per. Payback period initial investment annual payback Before making an investment its helpful to consider how long it may take to recover its cost.

Step by Step Procedures to Calculate Payback Period in Excel.

How To Calculate The Payback Period With Excel

How To Calculate Payback Period In Excel With Easy Steps

Calculating Payback Period Youtube

Calculate The Payback Period With This Formula

Payback Period Summary And Forum 12manage

What Is Payback Period Formula Calculation Example

How To Calculate The Payback Period With Excel

Discounted Payback Period Definition Formula Example Calculator Project Management Info

How To Calculate The Payback Period In Excel

Payback Period Formula And Calculator Excel Template

Payback Period Formula And Calculator Excel Template

Undiscounted Payback Period Discounted Payback Period

Discounted Payback Period Meaning Formula How To Calculate

How To Calculate The Payback Period With Excel

How To Calculate Payback Period Formula In 6 Min Basic Tutorial Lesson Review Youtube

Undiscounted Payback Period Discounted Payback Period

Calculation Of Payback Period With Microsoft Excel Ppt Download